Feb 2, 2024

Feb 2, 2024

Feb 2, 2024

Smart Money Moves: How to Make Your Dollars Work Harder for You

Smart Money Moves: How to Make Your Dollars Work Harder for You

Smart Money Moves: How to Make Your Dollars Work Harder for You

Making your money work harder is a key principle in achieving financial success. By adopting smart money moves, you can maximize your resources and build a stronger financial foundation. In this comprehensive guide, we'll explore practical strategies to help you make informed financial decisions, optimize your spending, and ensure that every dollar is contributing to your long-term goals.

Conducting a Financial Audit

Begin by conducting a thorough examination of your current financial situation. Review your income, expenses, and overall spending habits. Identifying areas where you can cut unnecessary costs and redirect those funds towards savings or investments is the first step in making your money work smarter.

Creating a Spending Plan

Develop a realistic and detailed spending plan to allocate your income effectively. Categorize your expenses into needs and wants, and look for opportunities to trim discretionary spending. This plan will serve as a roadmap for your financial journey, guiding you towards intentional and purposeful spending.

Embracing Strategic Saving

Saving is a cornerstone of smart financial management. Establish a dedicated savings account for both short-term and long-term goals. Set up automatic transfers to make saving a habit, and explore high-yield savings options to maximize your returns.

Optimizing Debt Management

Evaluate your current debts and interest rates. Consider consolidating high-interest debts or negotiating lower rates to minimize the financial burden. Prioritize debt repayment within your budget, freeing up more funds for saving and investing.

Maximizing Benefits and Rewards

Take full advantage of benefits and rewards programs offered by credit cards, bank accounts, and other financial services. These perks can include cash back, travel rewards, or discounts, providing an additional layer of value to your everyday spending.

Exploring Investment Opportunities

Look beyond traditional savings accounts and explore investment opportunities to grow your wealth. Consider low-cost index funds, individual stocks, or real estate, depending on your risk tolerance and financial goals.

Making your dollars work harder is not just about earning more; it's about optimizing your financial decisions and leveraging your resources effectively. By conducting a financial audit, creating a spending plan, embracing strategic saving, and exploring investment opportunities, you can pave the way to financial success. Remember, each small, smart money move contributes to the overall strength of your financial foundation, bringing you closer to your long-term goals.

Making your money work harder is a key principle in achieving financial success. By adopting smart money moves, you can maximize your resources and build a stronger financial foundation. In this comprehensive guide, we'll explore practical strategies to help you make informed financial decisions, optimize your spending, and ensure that every dollar is contributing to your long-term goals.

Conducting a Financial Audit

Begin by conducting a thorough examination of your current financial situation. Review your income, expenses, and overall spending habits. Identifying areas where you can cut unnecessary costs and redirect those funds towards savings or investments is the first step in making your money work smarter.

Creating a Spending Plan

Develop a realistic and detailed spending plan to allocate your income effectively. Categorize your expenses into needs and wants, and look for opportunities to trim discretionary spending. This plan will serve as a roadmap for your financial journey, guiding you towards intentional and purposeful spending.

Embracing Strategic Saving

Saving is a cornerstone of smart financial management. Establish a dedicated savings account for both short-term and long-term goals. Set up automatic transfers to make saving a habit, and explore high-yield savings options to maximize your returns.

Optimizing Debt Management

Evaluate your current debts and interest rates. Consider consolidating high-interest debts or negotiating lower rates to minimize the financial burden. Prioritize debt repayment within your budget, freeing up more funds for saving and investing.

Maximizing Benefits and Rewards

Take full advantage of benefits and rewards programs offered by credit cards, bank accounts, and other financial services. These perks can include cash back, travel rewards, or discounts, providing an additional layer of value to your everyday spending.

Exploring Investment Opportunities

Look beyond traditional savings accounts and explore investment opportunities to grow your wealth. Consider low-cost index funds, individual stocks, or real estate, depending on your risk tolerance and financial goals.

Making your dollars work harder is not just about earning more; it's about optimizing your financial decisions and leveraging your resources effectively. By conducting a financial audit, creating a spending plan, embracing strategic saving, and exploring investment opportunities, you can pave the way to financial success. Remember, each small, smart money move contributes to the overall strength of your financial foundation, bringing you closer to your long-term goals.

Making your money work harder is a key principle in achieving financial success. By adopting smart money moves, you can maximize your resources and build a stronger financial foundation. In this comprehensive guide, we'll explore practical strategies to help you make informed financial decisions, optimize your spending, and ensure that every dollar is contributing to your long-term goals.

Conducting a Financial Audit

Begin by conducting a thorough examination of your current financial situation. Review your income, expenses, and overall spending habits. Identifying areas where you can cut unnecessary costs and redirect those funds towards savings or investments is the first step in making your money work smarter.

Creating a Spending Plan

Develop a realistic and detailed spending plan to allocate your income effectively. Categorize your expenses into needs and wants, and look for opportunities to trim discretionary spending. This plan will serve as a roadmap for your financial journey, guiding you towards intentional and purposeful spending.

Embracing Strategic Saving

Saving is a cornerstone of smart financial management. Establish a dedicated savings account for both short-term and long-term goals. Set up automatic transfers to make saving a habit, and explore high-yield savings options to maximize your returns.

Optimizing Debt Management

Evaluate your current debts and interest rates. Consider consolidating high-interest debts or negotiating lower rates to minimize the financial burden. Prioritize debt repayment within your budget, freeing up more funds for saving and investing.

Maximizing Benefits and Rewards

Take full advantage of benefits and rewards programs offered by credit cards, bank accounts, and other financial services. These perks can include cash back, travel rewards, or discounts, providing an additional layer of value to your everyday spending.

Exploring Investment Opportunities

Look beyond traditional savings accounts and explore investment opportunities to grow your wealth. Consider low-cost index funds, individual stocks, or real estate, depending on your risk tolerance and financial goals.

Making your dollars work harder is not just about earning more; it's about optimizing your financial decisions and leveraging your resources effectively. By conducting a financial audit, creating a spending plan, embracing strategic saving, and exploring investment opportunities, you can pave the way to financial success. Remember, each small, smart money move contributes to the overall strength of your financial foundation, bringing you closer to your long-term goals.

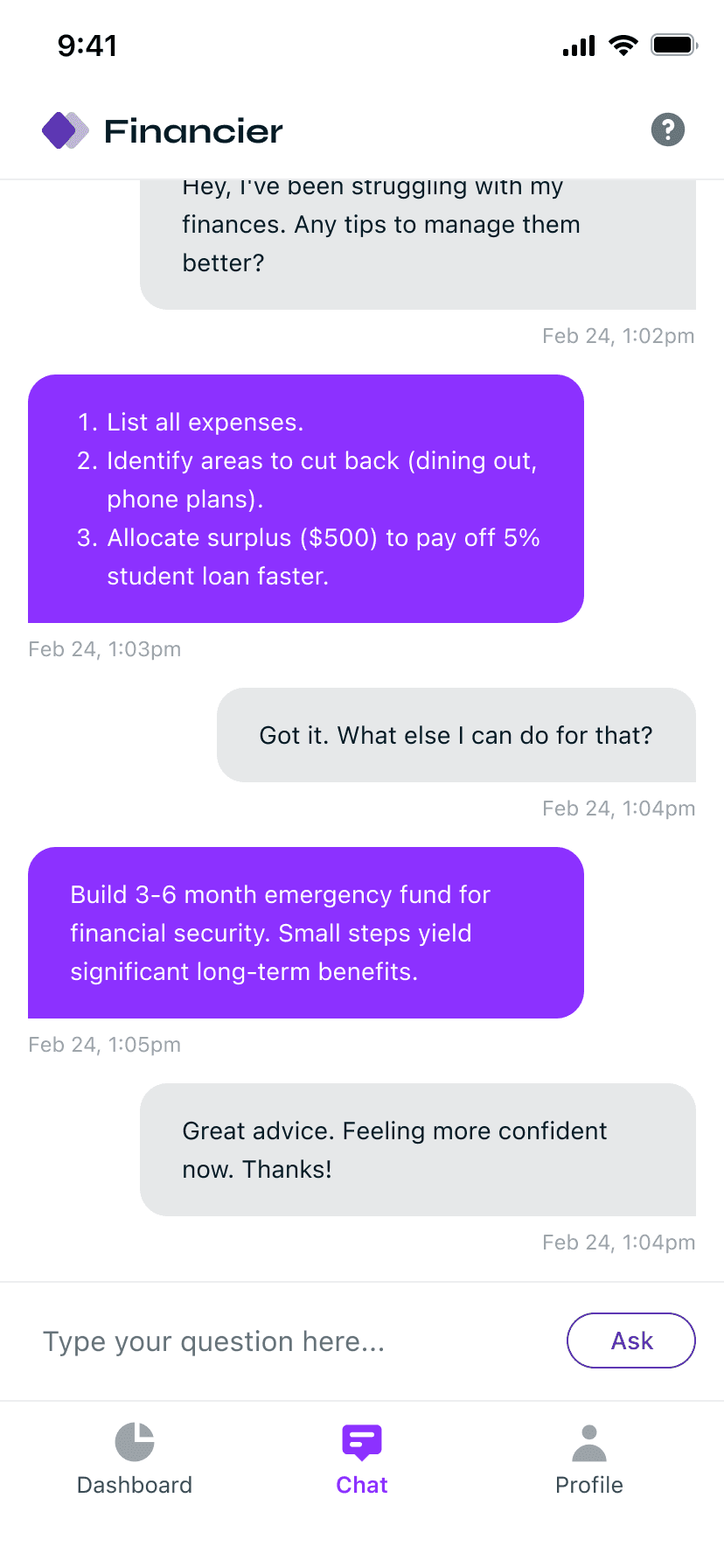

Financier

Save time and effort with our AI.

Bill payments to investment

rebalancing for efficiency.

© Copyright 2024 Financier

Financier

Save time and effort with our AI.

Bill payments to investment

rebalancing for efficiency.

© Copyright 2024 Financier

Financier

Save time and effort with our AI.

Bill payments to investment

rebalancing for efficiency.

© Copyright 2024 Financier