Feb 2, 2024

Feb 2, 2024

Feb 2, 2024

Mastering the Art of Budgeting: A Step-by-Step Guide to Financial Freedom

Mastering the Art of Budgeting: A Step-by-Step Guide to Financial Freedom

Mastering the Art of Budgeting: A Step-by-Step Guide to Financial Freedom

Achieving financial success begins with a fundamental skill: budgeting. It's the cornerstone of financial stability and a key step toward building a secure future. In this comprehensive guide, we'll walk you through the art of budgeting, providing step-by-step instructions and actionable tips to help you gain control of your finances and pave the way to financial freedom.

Categorizing Your Expenses

Divide your expenses into categories such as housing, transportation, food, and entertainment. This breakdown will help you identify areas where you can potentially cut costs and allocate more funds towards savings or debt repayment.

Setting Realistic Goals

Define your short-term and long-term financial goals. Whether it's building an emergency fund, paying off debt, or saving for a specific milestone, having clear objectives will give your budget purpose and direction.

Creating a Budget

Based on your income, expenses, and goals, create a realistic budget. Allocate specific amounts to each spending category, ensuring that your income covers your necessities while leaving room for savings and discretionary spending.

Tracking and Adjusting

Consistently track your spending against your budget using tools like apps or spreadsheets. Regularly review your financial situation and adjust your budget as needed. This adaptability ensures that your budget remains a dynamic tool that evolves with your changing circumstances.

Building an Emergency Fund

Financial emergencies can happen to anyone. Establishing an emergency fund equivalent to 3-6 months of living expenses provides a safety net, protecting you from unexpected setbacks without derailing your financial progress.

Paying Down Debt

Prioritize debt repayment within your budget. Identify high-interest debts and allocate extra funds to accelerate their payoff. Reducing debt not only improves your financial health but also frees up more money for saving and investing.

Saving and Investing

Allocate a portion of your budget to savings and investments. Whether it's contributing to a retirement account, building an investment portfolio, or saving for specific goals, these steps help grow your wealth over time.

Mastering the art of budgeting is a transformative journey toward financial freedom. By taking control of your finances, setting goals, and making informed decisions, you can pave the way to a secure and prosperous future. Commit to the discipline of budgeting, and watch as your financial success unfolds.

Achieving financial success begins with a fundamental skill: budgeting. It's the cornerstone of financial stability and a key step toward building a secure future. In this comprehensive guide, we'll walk you through the art of budgeting, providing step-by-step instructions and actionable tips to help you gain control of your finances and pave the way to financial freedom.

Categorizing Your Expenses

Divide your expenses into categories such as housing, transportation, food, and entertainment. This breakdown will help you identify areas where you can potentially cut costs and allocate more funds towards savings or debt repayment.

Setting Realistic Goals

Define your short-term and long-term financial goals. Whether it's building an emergency fund, paying off debt, or saving for a specific milestone, having clear objectives will give your budget purpose and direction.

Creating a Budget

Based on your income, expenses, and goals, create a realistic budget. Allocate specific amounts to each spending category, ensuring that your income covers your necessities while leaving room for savings and discretionary spending.

Tracking and Adjusting

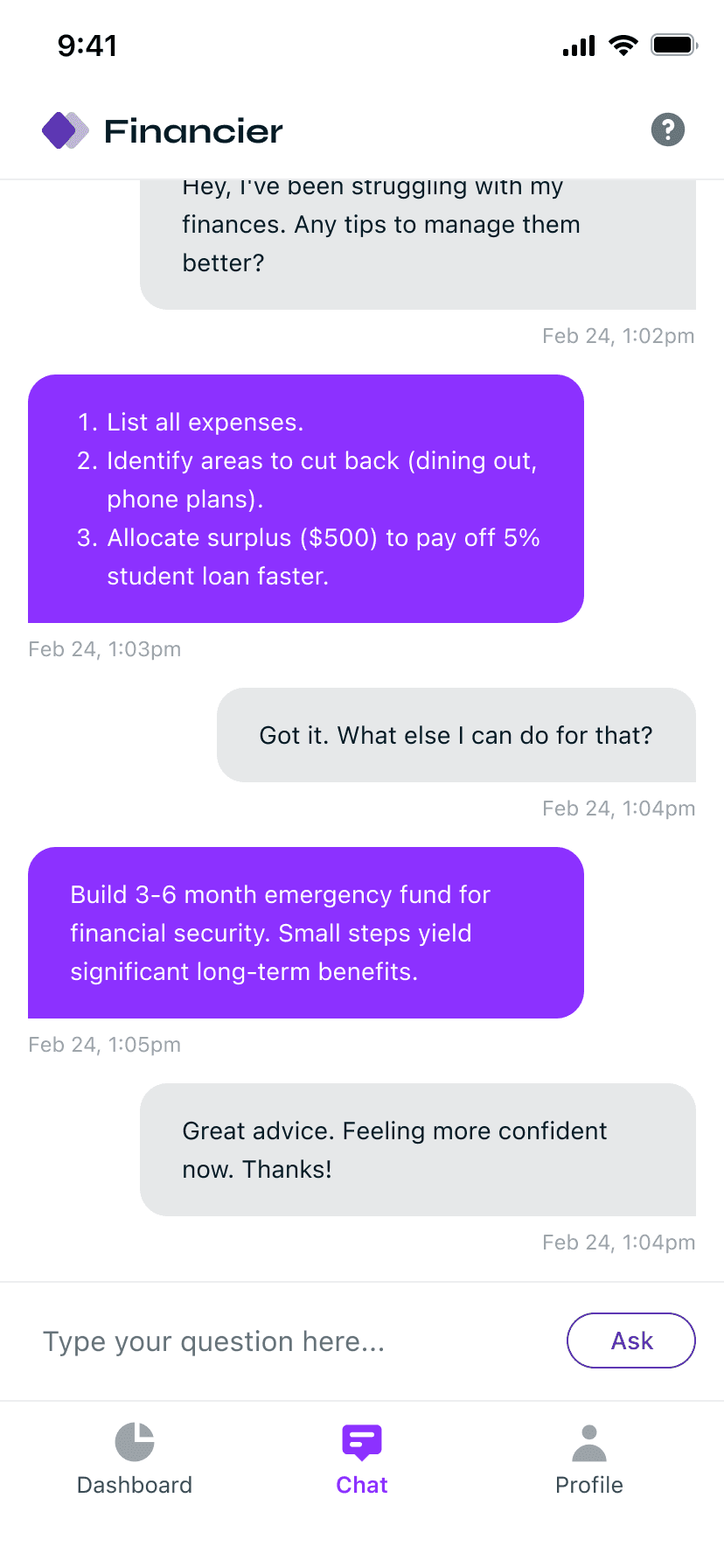

Consistently track your spending against your budget using tools like apps or spreadsheets. Regularly review your financial situation and adjust your budget as needed. This adaptability ensures that your budget remains a dynamic tool that evolves with your changing circumstances.

Building an Emergency Fund

Financial emergencies can happen to anyone. Establishing an emergency fund equivalent to 3-6 months of living expenses provides a safety net, protecting you from unexpected setbacks without derailing your financial progress.

Paying Down Debt

Prioritize debt repayment within your budget. Identify high-interest debts and allocate extra funds to accelerate their payoff. Reducing debt not only improves your financial health but also frees up more money for saving and investing.

Saving and Investing

Allocate a portion of your budget to savings and investments. Whether it's contributing to a retirement account, building an investment portfolio, or saving for specific goals, these steps help grow your wealth over time.

Mastering the art of budgeting is a transformative journey toward financial freedom. By taking control of your finances, setting goals, and making informed decisions, you can pave the way to a secure and prosperous future. Commit to the discipline of budgeting, and watch as your financial success unfolds.

Achieving financial success begins with a fundamental skill: budgeting. It's the cornerstone of financial stability and a key step toward building a secure future. In this comprehensive guide, we'll walk you through the art of budgeting, providing step-by-step instructions and actionable tips to help you gain control of your finances and pave the way to financial freedom.

Categorizing Your Expenses

Divide your expenses into categories such as housing, transportation, food, and entertainment. This breakdown will help you identify areas where you can potentially cut costs and allocate more funds towards savings or debt repayment.

Setting Realistic Goals

Define your short-term and long-term financial goals. Whether it's building an emergency fund, paying off debt, or saving for a specific milestone, having clear objectives will give your budget purpose and direction.

Creating a Budget

Based on your income, expenses, and goals, create a realistic budget. Allocate specific amounts to each spending category, ensuring that your income covers your necessities while leaving room for savings and discretionary spending.

Tracking and Adjusting

Consistently track your spending against your budget using tools like apps or spreadsheets. Regularly review your financial situation and adjust your budget as needed. This adaptability ensures that your budget remains a dynamic tool that evolves with your changing circumstances.

Building an Emergency Fund

Financial emergencies can happen to anyone. Establishing an emergency fund equivalent to 3-6 months of living expenses provides a safety net, protecting you from unexpected setbacks without derailing your financial progress.

Paying Down Debt

Prioritize debt repayment within your budget. Identify high-interest debts and allocate extra funds to accelerate their payoff. Reducing debt not only improves your financial health but also frees up more money for saving and investing.

Saving and Investing

Allocate a portion of your budget to savings and investments. Whether it's contributing to a retirement account, building an investment portfolio, or saving for specific goals, these steps help grow your wealth over time.

Mastering the art of budgeting is a transformative journey toward financial freedom. By taking control of your finances, setting goals, and making informed decisions, you can pave the way to a secure and prosperous future. Commit to the discipline of budgeting, and watch as your financial success unfolds.

Financier

Save time and effort with our AI.

Bill payments to investment

rebalancing for efficiency.

© Copyright 2024 Financier

Financier

Save time and effort with our AI.

Bill payments to investment

rebalancing for efficiency.

© Copyright 2024 Financier

Financier

Save time and effort with our AI.

Bill payments to investment

rebalancing for efficiency.

© Copyright 2024 Financier