Feb 2, 2024

Feb 2, 2024

Feb 2, 2024

Investing 101: A Beginner's Roadmap to Financial Independence

Investing 101: A Beginner's Roadmap to Financial Independence

Investing 101: A Beginner's Roadmap to Financial Independence

Entering the world of investing can be a pivotal step towards achieving financial independence. While the prospect may seem daunting to beginners, having a solid roadmap can demystify the process and empower you to make informed decisions. In this detailed guide, we'll explore the basics of investing and provide a step-by-step roadmap for beginners eager to embark on their journey towards financial independence.

Understanding the Basics of Investing

Before diving in, it's essential to grasp the fundamental concepts of investing. Understand the difference between stocks, bonds, and other investment vehicles. Familiarize yourself with key terms such as risk, return, and diversification to lay a solid foundation for your investment knowledge.

Setting Clear Investment Goals

Define your investment objectives and time horizon. Whether you're saving for a specific milestone, such as a home purchase or retirement, having clear goals helps shape your investment strategy and risk tolerance.

Building a Diversified Portfolio

Diversification is a key principle in mitigating risk. Spread your investments across different asset classes, industries, and geographic regions. This approach helps protect your portfolio from the impact of a single economic event.

Choosing the Right Investment Vehicles

Explore different investment options based on your risk tolerance and goals. Consider starting with low-cost index funds or exchange-traded funds (ETFs) for a diversified and cost-effective approach to investing.

Understanding Risk and Reward

Every investment involves a degree of risk. Understanding your risk tolerance is crucial in constructing a portfolio that aligns with your comfort level. Balancing risk and reward is an integral part of a successful investment strategy.

Consistent Contributions and Dollar-Cost Averaging

Consistency is key in building wealth through investing. Set up a regular contribution schedule, whether it's monthly or quarterly. Embrace dollar-cost averaging, a strategy that involves investing a fixed amount at regular intervals, which can reduce the impact of market volatility over time.

Investing can be a powerful tool on the path to financial independence. By understanding the basics, setting clear goals, and adopting a disciplined approach to building a diversified portfolio, even beginners can navigate the world of investing with confidence. Remember, patience and a long-term perspective are essential as you watch your investments grow and work towards achieving your financial dreams.

Entering the world of investing can be a pivotal step towards achieving financial independence. While the prospect may seem daunting to beginners, having a solid roadmap can demystify the process and empower you to make informed decisions. In this detailed guide, we'll explore the basics of investing and provide a step-by-step roadmap for beginners eager to embark on their journey towards financial independence.

Understanding the Basics of Investing

Before diving in, it's essential to grasp the fundamental concepts of investing. Understand the difference between stocks, bonds, and other investment vehicles. Familiarize yourself with key terms such as risk, return, and diversification to lay a solid foundation for your investment knowledge.

Setting Clear Investment Goals

Define your investment objectives and time horizon. Whether you're saving for a specific milestone, such as a home purchase or retirement, having clear goals helps shape your investment strategy and risk tolerance.

Building a Diversified Portfolio

Diversification is a key principle in mitigating risk. Spread your investments across different asset classes, industries, and geographic regions. This approach helps protect your portfolio from the impact of a single economic event.

Choosing the Right Investment Vehicles

Explore different investment options based on your risk tolerance and goals. Consider starting with low-cost index funds or exchange-traded funds (ETFs) for a diversified and cost-effective approach to investing.

Understanding Risk and Reward

Every investment involves a degree of risk. Understanding your risk tolerance is crucial in constructing a portfolio that aligns with your comfort level. Balancing risk and reward is an integral part of a successful investment strategy.

Consistent Contributions and Dollar-Cost Averaging

Consistency is key in building wealth through investing. Set up a regular contribution schedule, whether it's monthly or quarterly. Embrace dollar-cost averaging, a strategy that involves investing a fixed amount at regular intervals, which can reduce the impact of market volatility over time.

Investing can be a powerful tool on the path to financial independence. By understanding the basics, setting clear goals, and adopting a disciplined approach to building a diversified portfolio, even beginners can navigate the world of investing with confidence. Remember, patience and a long-term perspective are essential as you watch your investments grow and work towards achieving your financial dreams.

Entering the world of investing can be a pivotal step towards achieving financial independence. While the prospect may seem daunting to beginners, having a solid roadmap can demystify the process and empower you to make informed decisions. In this detailed guide, we'll explore the basics of investing and provide a step-by-step roadmap for beginners eager to embark on their journey towards financial independence.

Understanding the Basics of Investing

Before diving in, it's essential to grasp the fundamental concepts of investing. Understand the difference between stocks, bonds, and other investment vehicles. Familiarize yourself with key terms such as risk, return, and diversification to lay a solid foundation for your investment knowledge.

Setting Clear Investment Goals

Define your investment objectives and time horizon. Whether you're saving for a specific milestone, such as a home purchase or retirement, having clear goals helps shape your investment strategy and risk tolerance.

Building a Diversified Portfolio

Diversification is a key principle in mitigating risk. Spread your investments across different asset classes, industries, and geographic regions. This approach helps protect your portfolio from the impact of a single economic event.

Choosing the Right Investment Vehicles

Explore different investment options based on your risk tolerance and goals. Consider starting with low-cost index funds or exchange-traded funds (ETFs) for a diversified and cost-effective approach to investing.

Understanding Risk and Reward

Every investment involves a degree of risk. Understanding your risk tolerance is crucial in constructing a portfolio that aligns with your comfort level. Balancing risk and reward is an integral part of a successful investment strategy.

Consistent Contributions and Dollar-Cost Averaging

Consistency is key in building wealth through investing. Set up a regular contribution schedule, whether it's monthly or quarterly. Embrace dollar-cost averaging, a strategy that involves investing a fixed amount at regular intervals, which can reduce the impact of market volatility over time.

Investing can be a powerful tool on the path to financial independence. By understanding the basics, setting clear goals, and adopting a disciplined approach to building a diversified portfolio, even beginners can navigate the world of investing with confidence. Remember, patience and a long-term perspective are essential as you watch your investments grow and work towards achieving your financial dreams.

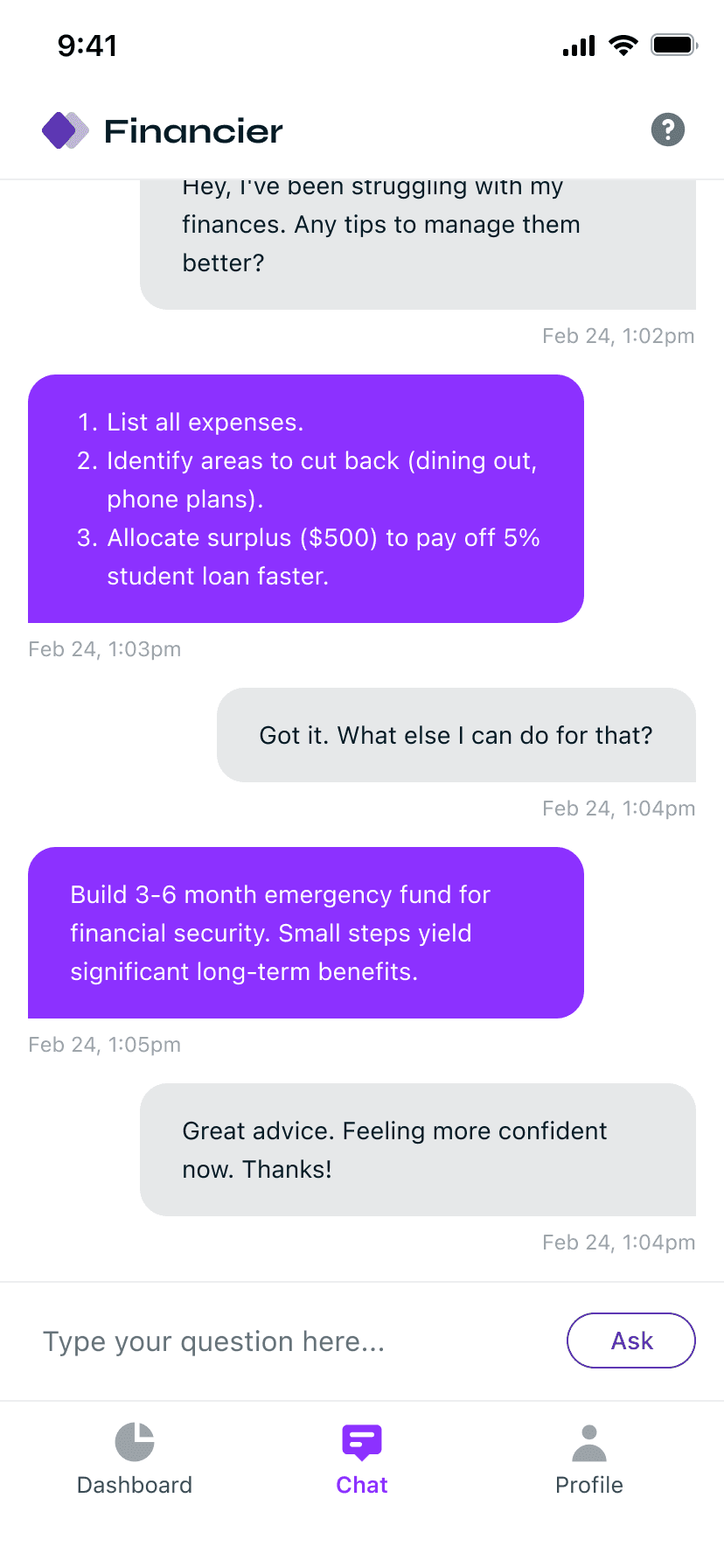

Financier

Save time and effort with our AI.

Bill payments to investment

rebalancing for efficiency.

© Copyright 2024 Financier

Financier

Save time and effort with our AI.

Bill payments to investment

rebalancing for efficiency.

© Copyright 2024 Financier

Financier

Save time and effort with our AI.

Bill payments to investment

rebalancing for efficiency.

© Copyright 2024 Financier