Feb 2, 2024

Feb 2, 2024

Feb 2, 2024

Building Wealth from Scratch: Strategies for a Strong Financial Foundation

Building Wealth from Scratch: Strategies for a Strong Financial Foundation

Building Wealth from Scratch: Strategies for a Strong Financial Foundation

Embarking on the journey to financial success often involves starting from the ground up. Building wealth from scratch is not only achievable but can be a transformative process that sets the stage for a secure and prosperous future. In this detailed guide, we will explore practical strategies and steps to help you construct a strong financial foundation, regardless of your current financial situation.

Assessing Your Current Financial Landscape

Begin by taking stock of your current financial situation. Evaluate your assets, liabilities, and overall net worth. Understanding where you stand financially provides the clarity needed to set realistic goals and create a roadmap for building wealth.

Setting Clear Financial Goals

Define your financial objectives, both short-term and long-term. Whether it's creating an emergency fund, saving for a home, or planning for retirement, having specific and achievable goals provides direction and motivation on your wealth-building journey.

Creating a Realistic Budget

Budgeting is a fundamental aspect of wealth-building. Develop a budget that aligns with your income, accounting for both necessities and discretionary spending. This financial roadmap will help you prioritize savings, debt repayment, and investment contributions.

Emergency Fund as a Safety Net

Building wealth requires protection against unexpected setbacks. Establishing an emergency fund equivalent to 3-6 months of living expenses provides a financial safety net, allowing you to weather unforeseen challenges without derailing your progress.

Tackling Debt Strategically

Address any existing debts strategically within your budget. Prioritize high-interest debts and allocate extra funds for faster repayment. Reducing debt not only improves your financial health but also frees up more money for savings and investments.

Embracing a Savings Mindset

Cultivate a savings mindset by consistently setting aside a portion of your income. Automate contributions to your savings account to ensure consistency, and consider exploring high-yield savings options to maximize your returns.

Investing for Long-Term Growth

Wealth-building extends beyond savings to include strategic investments. Explore investment options such as retirement accounts, stocks, and other vehicles that align with your risk tolerance and long-term financial goals.

Building wealth from scratch is a gradual process that requires discipline, strategic planning, and a commitment to financial growth. By assessing your current situation, setting clear goals, and implementing practical strategies like budgeting, saving, and investing, you can construct a strong financial foundation that empowers you to achieve lasting financial success. Remember, the journey may take time, but the rewards are well worth the effort.

Embarking on the journey to financial success often involves starting from the ground up. Building wealth from scratch is not only achievable but can be a transformative process that sets the stage for a secure and prosperous future. In this detailed guide, we will explore practical strategies and steps to help you construct a strong financial foundation, regardless of your current financial situation.

Assessing Your Current Financial Landscape

Begin by taking stock of your current financial situation. Evaluate your assets, liabilities, and overall net worth. Understanding where you stand financially provides the clarity needed to set realistic goals and create a roadmap for building wealth.

Setting Clear Financial Goals

Define your financial objectives, both short-term and long-term. Whether it's creating an emergency fund, saving for a home, or planning for retirement, having specific and achievable goals provides direction and motivation on your wealth-building journey.

Creating a Realistic Budget

Budgeting is a fundamental aspect of wealth-building. Develop a budget that aligns with your income, accounting for both necessities and discretionary spending. This financial roadmap will help you prioritize savings, debt repayment, and investment contributions.

Emergency Fund as a Safety Net

Building wealth requires protection against unexpected setbacks. Establishing an emergency fund equivalent to 3-6 months of living expenses provides a financial safety net, allowing you to weather unforeseen challenges without derailing your progress.

Tackling Debt Strategically

Address any existing debts strategically within your budget. Prioritize high-interest debts and allocate extra funds for faster repayment. Reducing debt not only improves your financial health but also frees up more money for savings and investments.

Embracing a Savings Mindset

Cultivate a savings mindset by consistently setting aside a portion of your income. Automate contributions to your savings account to ensure consistency, and consider exploring high-yield savings options to maximize your returns.

Investing for Long-Term Growth

Wealth-building extends beyond savings to include strategic investments. Explore investment options such as retirement accounts, stocks, and other vehicles that align with your risk tolerance and long-term financial goals.

Building wealth from scratch is a gradual process that requires discipline, strategic planning, and a commitment to financial growth. By assessing your current situation, setting clear goals, and implementing practical strategies like budgeting, saving, and investing, you can construct a strong financial foundation that empowers you to achieve lasting financial success. Remember, the journey may take time, but the rewards are well worth the effort.

Embarking on the journey to financial success often involves starting from the ground up. Building wealth from scratch is not only achievable but can be a transformative process that sets the stage for a secure and prosperous future. In this detailed guide, we will explore practical strategies and steps to help you construct a strong financial foundation, regardless of your current financial situation.

Assessing Your Current Financial Landscape

Begin by taking stock of your current financial situation. Evaluate your assets, liabilities, and overall net worth. Understanding where you stand financially provides the clarity needed to set realistic goals and create a roadmap for building wealth.

Setting Clear Financial Goals

Define your financial objectives, both short-term and long-term. Whether it's creating an emergency fund, saving for a home, or planning for retirement, having specific and achievable goals provides direction and motivation on your wealth-building journey.

Creating a Realistic Budget

Budgeting is a fundamental aspect of wealth-building. Develop a budget that aligns with your income, accounting for both necessities and discretionary spending. This financial roadmap will help you prioritize savings, debt repayment, and investment contributions.

Emergency Fund as a Safety Net

Building wealth requires protection against unexpected setbacks. Establishing an emergency fund equivalent to 3-6 months of living expenses provides a financial safety net, allowing you to weather unforeseen challenges without derailing your progress.

Tackling Debt Strategically

Address any existing debts strategically within your budget. Prioritize high-interest debts and allocate extra funds for faster repayment. Reducing debt not only improves your financial health but also frees up more money for savings and investments.

Embracing a Savings Mindset

Cultivate a savings mindset by consistently setting aside a portion of your income. Automate contributions to your savings account to ensure consistency, and consider exploring high-yield savings options to maximize your returns.

Investing for Long-Term Growth

Wealth-building extends beyond savings to include strategic investments. Explore investment options such as retirement accounts, stocks, and other vehicles that align with your risk tolerance and long-term financial goals.

Building wealth from scratch is a gradual process that requires discipline, strategic planning, and a commitment to financial growth. By assessing your current situation, setting clear goals, and implementing practical strategies like budgeting, saving, and investing, you can construct a strong financial foundation that empowers you to achieve lasting financial success. Remember, the journey may take time, but the rewards are well worth the effort.

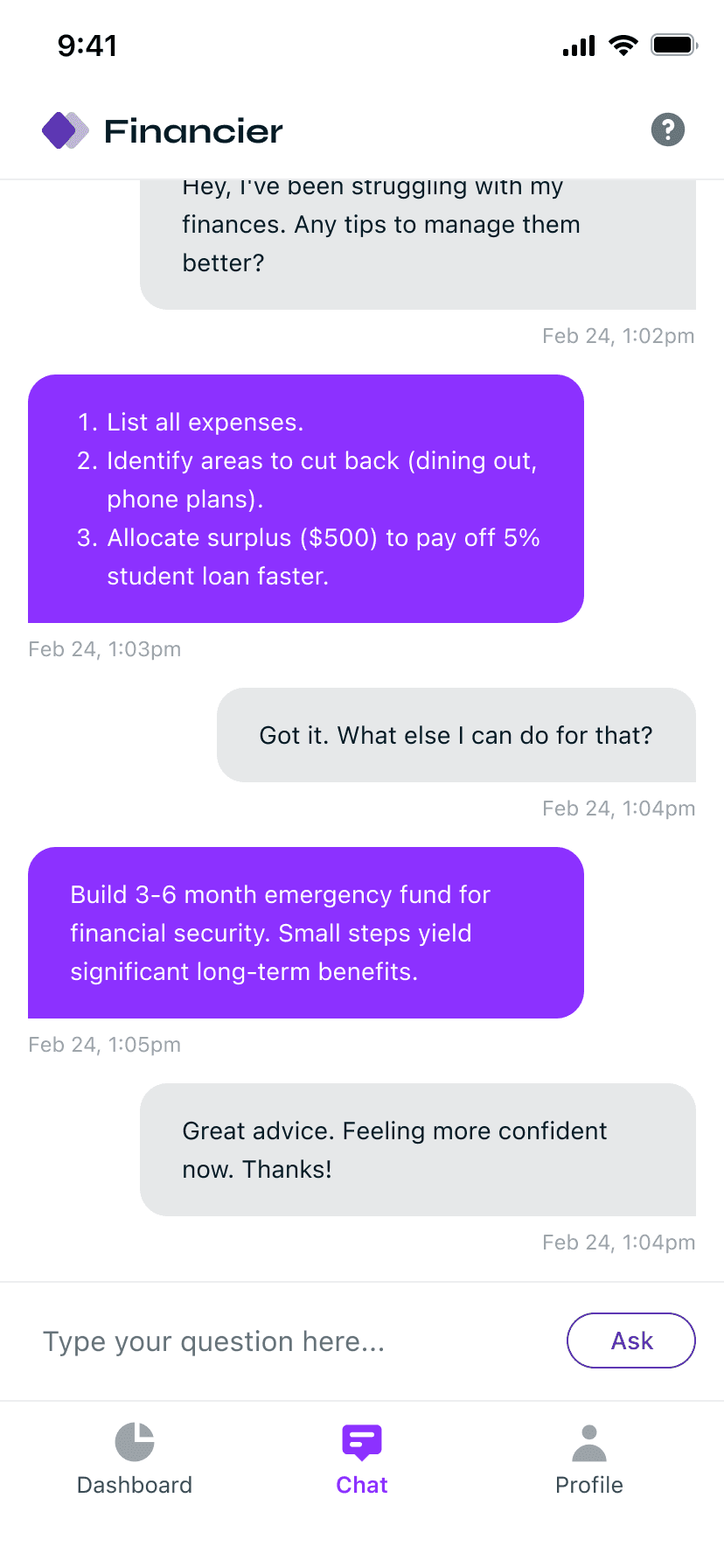

Financier

Save time and effort with our AI.

Bill payments to investment

rebalancing for efficiency.

© Copyright 2024 Financier

Financier

Save time and effort with our AI.

Bill payments to investment

rebalancing for efficiency.

© Copyright 2024 Financier

Financier

Save time and effort with our AI.

Bill payments to investment

rebalancing for efficiency.

© Copyright 2024 Financier